Retirement planning is a very personal decision. There is no one size fits all plan for everyone, but there are some things to keep in mind when choosing your retirement plan.

If you are in late 40s to or have reached age 50, and start thinking about retirement, below are 9 Money Tips To Catch Up On Your Retirement Planning, Every 50s Should Start Doing.

Retirement Plan For Finance

#1: Review retirement budget

There are 2 ways for you to come up with a retirement budget;

a. Calculate manually.

You need to know what your monthly expense after retirement. It shall include food, utilities, health insurance, longterm loan, transport & wants.

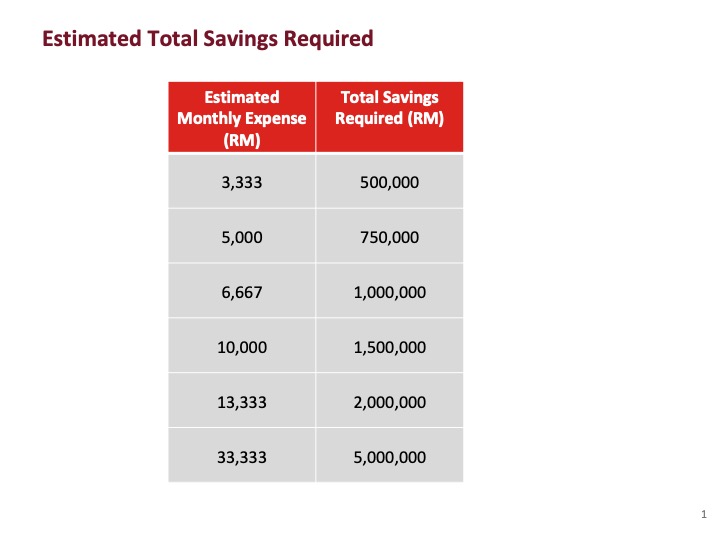

Once you’ve determined the monthly expenses, then you calculate backward how much savings that you need to build up.

For example, if you want to have a $10,000 monthly expense, then you need to have $1.5 Million in your total account.

Refer table below, for the total savings amount required.

During your retirement, aim to withdraw not more than 7% of your total savings every year.

b. By Fidelity suggestion.

In order to retire comfortably, Fidelity suggested a person should have 8 – 10 times of their annual salary saved (ie total at EPF, ASB, Unit Trust, PRS, FD, Tabung Haji, etc) by the time they retire.

For instance,

Let say, you earn $10,000 per month.

Based on above, it means you need to have a total savings of $1.2 Mil ($10,000 x 12 months x 10 times).

So, how much you can safely withdraw when you retire?

As a rule of thumb, aim to withdraw no more than 7% of your total savings every year.

Example:

With $1.2 Million, should you take 7% annually for your expenses, then it will give you about $7,000 monthly (ie. $1.2 Million x 7% / 12 months).

With a monthly income of $7,000, it translates to 70% of your last withdrawn salary. That is a good replacement income for a comfortable retirement.

#2: Downsize or pay off debt

One of the greatest threats to retirement perhaps not be saving too little, but owing too much.

When you reach age 50, you should not have consumer debt such as credit card debt, personal loan, cash reward loan, etc. If you have consumer debts, you need to pay those off the soonest.

In addition, try paying off other debts such as car loan, and home loan before you quit working.

Related: How To Reduce Debt Faster.

#3: Save monthly to boost your retirement savings

A study showed that 70% of ex-EPF members exhausted the EPF savings within 10 years. Hence you need to complement your EPF money with your own personal savings.

Even at the age of 50, it’s never too late to start saving for retirement. You still have 5 to 10 years or more to save.

Consider this scenario:

You have cash of $10,000 that you saved. You use that $10,000 and invest in an investment account that gives an annual return of about 8%. Besides that, you also save $800 every month.

After 10 years, the savings will be about $160,600.

Although it might not be able to cover your full retirement, at least you have something instead of nothing.

The fastest way to boost retirement savings is to save 15% to 20% of your monthly income. This will help you ‘catch up’ on your retirement planning.

#4: Diversify your financial portfolio

In order to reduce your risk of losing all of your money, it is important “not to put all eggs in one basket”.

Diversification of a financial portfolio is important to reduce your risk. The more diverse portfolio you have, the safer it is.

For a good retirement planning, my recommendation is:

· 50% – Conventional funds (EPF, ASB, ASW, Tabung Haji)

· 30% – Principal funds , PRS or Unit Trust (equity 60%, balance & sukuk 40%)

· 10% – Emergency fund

· 10% – High risk investment (if brave enough)

Related: Learn To Invest In Unit Trust Confidently

#5: Insulate your career

Job loss during the 50s can be painful, and many workers that been laid off at that age have difficulty finding another job with similar pay or position.

However, there are some things you can do to ensure your skills stay useful and yourself is valued by the company. This includes increasing your skills, staying up to date with current technology and development in your industry.

#6: Plan for medical cost during retirement

As people age, their health begins to decline – this is a natural process.

Medical cost is not cheap nowadays. Hence, a good and adequate medical insurance becomes essential for those over that age 50s.

And, should you have a medical card, please ensure your annual budget would be able to cover the medical card’s premium fees.

In case you’re planning to get a new medical insurance, my quick tips as below;

- Get medical insurance when you are in good health. If you have a health problem, you might not qualify to own a medical policy.

- Average lifespan of Malaysian is 75, so ensure plan provides protection beyond that.

- Look for a higher annual limit to help cope better with escalating medical costs

#7: Explore ways to cut spending

Another way to boost retirement savings is to cut down on what’s you are spending now. Start to check your current budget.

Imagine, if you can cut out some spending, then with discipline, you could allocate that money into your retirement savings instead.

Some ideas to reduce monthly expenses:

· Cancel unutilized monthly subscription eg. gym, magazine, club membership, etc

· Save on home electricity such as lightings, aircon, etc.

· Save on groceries

· Stop smoking

· Cook meal at home instead of dining out

· Get a better deal on car insurance

· Reduce or cut unnecessary routine expenses eg. Expensive coffee, lunch out, water bottles, etc.

You might be surprised to learn how much you could save by cutting back on some of your monthly expenses.

#8: Avoid a new 20-year home loan

This could be buying a new house or refinance the existing home. Some people do it with the idea that they will pay it off before the retirement date or use EPF money to settle it.

I do not recommend people age 50s to refinance their home loan or do debt consolidation via home loan. Why?

This is because you’re not paying off the debt, you’re only reshuffling the debt. Plus, you will incur additional fees of about 10-12% from the total loan (ie. Legal fees, MRTA, Valuation fees, etc).

Instead, choose to clear the debts.

#9: Determine which passive income that suits your best during retirement

Passive income is a great way to fund your retirement expenses. It could be from your;

· dividend portfolio such as EPF, ASB, ASW, Tabung Haji, Principal or Unit Trust funds, etc

· rental income from property investment

· online income from affiliate marketing ie. blog site, you-tube, etc.

· digital product income such as ebook, webinar, mobile apps, online course, etc.

It’s important for you to understand which form of passive income that suit you the most. Invest your time and money in an asset or activity that will generate a stream of cash for many years without much effort on your part.

Retirement Planning For Non Finances

#10: Ask or negotiate for a mutual separation scheme (MSS) package

Whether you plan to retire early or not, there are plenty of steps that can be taken towards ensuring a sound financial future.

For instance, assuming that you’re planning to retire earlier than the compulsory retirement age (60), my advice would be, don’t just quit your job; ask for an MSS package instead!

If you have done well at work so far and it’s no harm asking about this with your company – then do so!

My quick tips;

· Check with HR to see what kind of mutual scheme package or others your company offers. You need to know where you stand.

· Should you have a good relationship with your manager, get his help to navigate the package. Otherwise, approach someone in HR instead.

· Show respect. No matter how’s your relationship with your boss or company, it’s best to write your MSS request in a good and professional manner.

· It’s important that your letter or email on MSS proves you’ve thought your request through. Rather than general, try to explain why you believe your request is important.

#11: Clean up your computer

Make sure you remove personal data or information from work. That way, you would not have to worry about someone accessing your personal information in your absence.

Items on your computer that you should clean up before leaving the company;

· Personal documents

· Personal email messages

· Downloaded software or programs that’s not related to the job

· Internet browsing history, saved passwords, etc.

#12: Health check-up annually

Should your company covers a health screening check-up, then ensure you make use of the benefits and do it every year.

Or else, you can still do it and claim from LHDN (Lembaga Hasil Dalam Negeri) tax-relief. The government allows up to RM 1,000 for a full health screening.

Health check-up is essential in order for you to know the condition of your body early and you have a chance to improve it while you’re still working.

#13: Expand your social network

“People tended to become lonelier after retirement if they had little contact with friends before retirement and if the contact frequency decreased over the retirement transition” – John Cacioppo

During your working career, you probably spend most of your day interacting with colleagues and clients. When you reach age 50, start to expand your social circle to people who are not associated with your job.

You can reach out to neighbors, ‘kawan surau’, do volunteering work, good relationship with family, new friends or groups of similar interest, etc.

#14: Stay healthy and Be active

You never know how many years of retirement you will have. So, it is best to take care of your health.

Besides savings a lot of money on medical bills in the long run, staying fit may also help to improve how you feel about yourself with an increase self-esteem.

Eat well, follow a good diet, walk or engage in regular exercise, quit smoking cigarettes if possible, limit alcohol intake, and keep your blood pressure at a normal level. All these help in retirement planning.

#15: You have a plan and purpose during retirement

Having a plan for what to do during retirement is also important. Otherwise, like many people, you can easily feel bored and lost.

The key to creating purpose during retirement is to exercise your mind and body.

There are many ways to find purpose in retirement, such as;

- Volunteering time and efforts at a non-profit organization

- Work as a consultant, freelancers, or be a speaker

- Mentoring school or college students

- Go travelling and get a new experience

- Get involved with your religious or neighborhood group

- Learn new hobbies or skills

Final thought

How do you want to spend your retirement? Traveling with family and friends, enjoying hobbies that have been put on hold for years or decades, being involved in the community and giving back.

If you are late getting into your retirement planning, there’s still time to do a ‘catch up’ game. But you have to be determined and start to put the right habits in place that will help you get to the target you set.

You cannot change the past, but you can change the future.

So, don’t wait and start making progress.