Getting out of debt is not impossible. Like any goal, it requires steps, action plans, and determination to accomplish it. You just need to find a technique or a system you can follow and apply it to your needs.

Hence, this is 10 Practical Ways To Reduce Debt Faster

1. Relook at your old housing loan (especially for house purchase in year 2007 and before) and negotiate.

Many people think that housing loan is fixed, and nothing can be done. The good news is it can be negotiated. I did revisit my house loan’s interest and have helped many of my clients. And this had saved hundreds to thousands of ringgit per year without having to move banks.

2. Consider Cashing in your life insurance.

If you have insurance life policies that have built up cash value, this may be an alternative to reduce your debt quickly. The cash value might not be big, however, it does help to ease the burden.

3. Do a credit card balance transfer.

Credit card interest rates normally range from 18% – 20%. Hence one an effective way to reduce the interest is by doing a balance transfer to another that offer a 0% promotion rate for 12-24 months.

If you do a balance transfer, please be disciplined to complete paying it within 12 months. If not, once the promotional rate expires, the interest rate will go back to 18%.

4. Use your tax refund to pay down debt

If you happen to get a tax refund from LHDN, please consider paying down the debt of the highest interest eg. Credit card or personal loan. I understand the temptation to use the tax refunds to purchase stuff but paying the debt will make you feel much relief.

5. Pay more than the minimum payment

The less you pay towards your debt balance every month, the longer it’ll take to pay off your debts. Any remaining debt balance will significantly increase interest charges every month. And eventually, the interest fees will increase the debt that you already have.

Especially for a credit card where the interest rates at 18 – 20%. The more you pay, you will save more money on interest. You could save hundreds, or even thousands of ringgits in interest just by raising your monthly credit card payment.

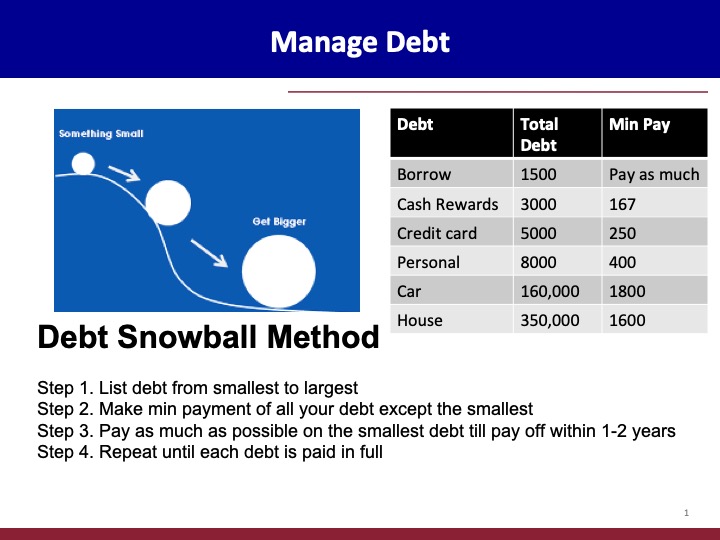

6. Use the ‘Debt Snowball’ method.

The Debt Snowball strategy helps you pay off your debt by knocking the smallest debts and build momentum towards the larger ones.

Debt snowball strategy is simple and involves just a few steps;

1. Make a listing

List down all your debts. Order them from the smallest balance at the top of the list to the largest on the bottom.

2. Pay the minimum

Pay the minimum of all the loans and credit cards except the smallest balance.

3. Pay extra on the smallest balance

Every month, pay as much as possible towards the debt at the top of your list. Your goal is to pay the debt off within 1 or 2 years.

4. Pay the next debt balance

After finish paying off the smallest debt balance, cross it off the list and move on to the next-smallest balance. Take everything you’re paying on the smallest debt and apply to the next one. As you finish paying each debt, your total payment toward the next one will grow larger and larger.

Repeat this method until you finish paying all your debts.

See illustration below

7. Sell things that you don’t need.

If you don’t use it, why don’t you make a little money on it. Selling old household items you are not using is a great way to clear out your storage and make some cash to pay your debts.

You could sell them on eBay, Facebook Marketplace, or at a garage sale.

8. Drop expensive habits.

Most of us have habits that rob our hard-earned cash. Below are a list of expensive habits you could drop to pay your debts;

· Frequent eating out – Do cook at home

· Spend on expensive clothes. – Forget designer labels, avoid dry cleaning clothing, etc.

· Impulse buying – You see things, you like then you buy. You see a sale, you are attracted to the big discount then you buy. If you don’t control this, you can easily get into bad debt.

· Buy brew coffee – Do you stop at a coffee shop every day? Brew coffee cost RM 15. If you buy it on an alternate day, you can easily save RM 200 monthly.

· Full-blown your air-condition – Experts recommend that 25 degrees Celsius is the best temperature for money savings.

· Make a late payment of your bills or credit card – every late payment incurred late charges.

· Driving like Hollywood action movie – don’t drive too fast and burn the petrol unnecessarily. Most cars are fuel-efficient at 80 – 90km per hour.

· Throwing food away – When you overspend on groceries, you might end up throwing them due to expiry or wastage. Hence, do grocery with a list, don’t shop while you’re hungry.

9. Increase your income or Ask for a raise

Finding ways to increase your income is a great help to reduce your debt faster.

· Work for overtime hours

· Make money from a hobby

· Make money blogging

· Offer service as a virtual assistant

Ask for a raise. The worst that happens is the boss says no. If they say yes, apply the extra income to pay down your debt. Besides that, put aside extra income by building your emergency fund.

10. Spend less than you earn.

Many people get into debt and stay in debt because they tend to buy what they want, although they could not afford it.

So, learn to Simplify your life and spend less.

A great way to spend less is to pay with cash or your debit card.

Final Thought

Don’t spend every day obsessing thinking over the debts – this can stress you out and demotivate you.

Once you have a plan in place, be disciplined to stick with it and have a belief that ‘things will get better’. InsyaAllah.

Well composed articles like yours renews my faith in today’s writers.You’ve

written information I can finally agree onn and also use.Many thanks for

sharing.

Thanks so much Hot Water Heater Repair Near Me for reading. I’m happy that you find the article practical and useful. I truly appreciate you.

Pretty! This has been ann extremely wonderful post.

Thanks for providing this info.

My pleasure Greek Voice Over Actors. Glad that you like the information.

Thanks a lot

Would love to peretually gett upodated outstanding web blog!

Thanks so much #Greekfemalevoice for your kind comments. Love it

Very good post! We will be linking to this great content on our website.Keep up the great

writing!

I have found very interesting your article.It’s pretty worth enough

forr me. In myy view, if all website owners and bloggers made gpod content as you did, the

web will be a lot more useful than ever before.

Excellent post. I wass checking continuously this blog and I am impressed!

Extremely useful information. I care for such information a lot.

I was looking for this certain information for a very long time.Thank

you and good luck.