In life, things happen all the time. As much we want to predict the future, sometimes reality does bite and give us surprises.

It could be your car gets flat tires or a major breakdown, or you lose your job or you get a pay cut. These are examples of things that might pop up unexpectedly.

By building a savings called an emergency fund, you can get yourself prepared for the unexpected. Plus, you don’t need a need to turn to credit card debt, borrow from family or friends or take loan from an illegal loan shark (ah-long) and then create unnecessary stress.

Here’s a quick guide about Emergency Fund and what you need to know about them.

Here’s a quick guide about Emergency Fund and what you need to know about them

What is emergency fund?

An emergency fund is money that you set aside that is used to help pay for unexpected expenses. Examples such as car repair, home appliance repair or replacement, unexpected medical bill,s etc.

It also provides peace of mind if anything happens to you ie. loss of your job, unexpected major car fixes, etc.

Why do you need an emergency fund?

Many people think they might not need an emergency fund right now. Perhaps because they feel their job are secured or they are in a high demand field which could easily find a new job.

Another reason perhaps they can use a credit card in case of emergency. However, you need to remember that the credit card is not an income. If you don’t manage your credit card usage properly, you might get into bad debt.

A study from Bank Negara Malaysia (BNM) found that 75% of Malaysians find difficulty saving RM 1000 for emergency needs.

The savings you create today will build your flexibility in your life. It also gives you the freedom to make decisions as you are not strictly tied to one source of income.

How big the emergency fund should be?

A person’s emergency fund varies from situation to situation.

However, most financial experts agree that a good emergency fund should be able to cater to the monthly expenses of three to six months.

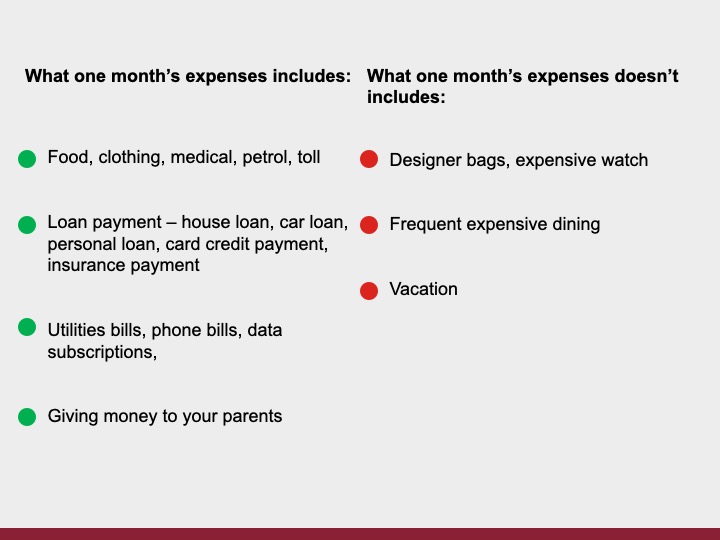

To determine this amount, add up how much you spend in a single month on things you are committed to paying ie. Food, utility bills, transport, clothes, loan payments, etc.

Once you know the number of your monthly expenses, multiply that by 3 or 6 months. That’s your emergency fund target amount.

How to build an emergency fund?

1. Calculate the amount that you need to save.

Determine how much you need to save for your emergency fund. Simply calculate your monthly expenses and multiply 3 – 6 months.

For example, If your essential monthly expenses is RM 4,000. It means you need to save RM 12,000 – RM 24,000 in your emergency savings account.

2. Set monthly savings into the budget.

The easiest way to build an emergency fund is to make savings part of your budget. Put aside 5-10% of your income or a specific value of RM 200 for savings. Budgeting your savings will speed up your emergency fund.

3. Automate your savings.

Automation is another great way to save for emergency funds. It helps to prevent the temptation of spending money than saving it. You can do it via auto-debit to your designated savings account.

By automating it, you are disciplined in saving money, prevent from money mishaps, and make you save money easier.

4. Save from refunds or bonuses.

You can increase your emergency savings quickly through a tax refund or salary bonuses.

I understand the temptation to use tax refund or salary bonus to purchase stuff but savings some of them to the emergency fund will make you feel much relief.

5. Keep the change.

If you usually spend cash, you can take your spare change or maybe RM 1 or RM 5, and drop some in a jar at home. When the jar fills up, take it to the bank and deposit the cash.

Where should I keep my emergency fund?

In principle, an emergency fund should be liquid, easy to access, safe from market risk, and has a decent interest (profit). This way you can easily withdraw them as and when you need the cash without having to wait.

Don’t put your emergency fund at places with;

· high volatility ie stock market, forex trading, bitcoin

· not liquid and rigid ie. real estate

· lock-in period ie. fixed deposit

· easily to be used ie. your savings or current account

· no security and no interest ie. under your pillowcase or mattress

The best savings account for your emergency fund;

1. ASB (Amanah Saham Bumiputera)

ASB is a unit trust fund with a fixed RM 1 per unit. The investment is mostly for Bumiputera citizens in Malaysia. Each eligible investor is limited to a maximum investment of RM 200,000.

The investment in ASB is low risk, with consistent and competitive annual returns. Among the advantages are no upfront fees and instant withdrawal.

2. Tabung Haji (TH)

TH is an institution for investment and pilgrimage affairs. The investment is mostly for Islamic Malaysian citizens.

The investment at TH is low risk and guaranteed by Government as per the Hajj Act 1995, and the zakat is paid on behalf of the depositors.

Among the advantages are no upfront fees, no savings limit, and instant withdrawal.

3. ASW (Amanah Saham Wawasan) or AS1M (Amanah Saham 1 Malaysia)

Both are unit trust fund under PNB with a fixed RM 1 per unit. The investments are for non-Bumiputera citizens in Malaysia.

Similar to ASB, the investment in ASW and AS1M is low risk, with consistent dividends. However, the investment has a limited quota of investors and a maximum investment per investor of RM 50,000.

4. Principal funds: Sukuk or Money market

Principal Asset Management Berhad is an asset manager, headquartered in Malaysia.

Money market is a unit trust that invests in a highly liquid instrument such as short-term bond or cash. The risk is low, consistent annual returns, tax exempted, and no upfront fees.

Sukuk is a unit trust that invests in Islamic bond long-term. Similar to the Money market, it’s low risk, tax exempted, and gives better annual returns. However, Sukuk imposes an application fee of 1% from the amount of investment.

When should I use my emergency fund?

Having some direction on when to use your emergency fund, will make you decide the best use of your savings;

1. Living expenses after a job loss or pay cut

2. Unexpected major car repairs

3. Emergency home or home appliance repairs

4. Emergency or necessary medical bills

You should not use an emergency fund for leisure spending such as phone upgrades, new clothing, vacation, big sale promotion, etc.

Is Insurance an emergency fund?

Insurance policies are essential, but not as an emergency fund. You should have an insurance policy for medical or high-ticket emergencies. Plus, insurance claims can take time to process.

What if I have debt?

When you’re stuck in debt, saving up for an emergency fund might be difficult. Or perhaps the last thing in your mind.

But rather not to save at all, it’s better to do both: Pay off debt while building your emergency fund. You can do it by simply put aside RM 50 – RM 100 per month.

Bak kata pepatah “Sikit-sikit, lama-lama jadi bukit”

(Bit by bit, over time, it will accumulate into a mountain)

What to do after you save an emergency fund?

Conclusion

Having an emergency fund is essential and should be everyone’s financial goal.

“You cannot control whether you’ll be on job for the next 5 – 20 years. But you can contribute to savings, and that will prepare you for the unexpected.”

About the Author

Khairul, is a Certified Consultant registered with Principal, founder of Khairul Abu Bakar blogsite and the LinkedIn Spotlight 2019.

I enjoy reading through your website. Thanks!

Thanks so much Εκφωνητες Θεσεις Εργασιας for reading and your kind comments. I truly appreciate you.

Cheers, Khairul

Hello! I wish to say that this post is awesome, great written and come with approximately all important infos.

I’dlike to look extra posts like this! 🙂

Thanks so much Ho3 Policy for reading and your kind comments. It gives me motivations to keep writing and postings.

I’m grateful and appreciate you.

Cheers, Khairul

Woulpd love to perpetually get updated outstanding web blog!

I got this site from my pal who shared with me concerning this

webbsite aand now this time I am browsing this website and reading very

informative articles or review at this place.

Nice post. I was checking continuously this blog and I’m impressed!

Very useful information specially the last

part 🙂 I care for such info a lot. I wwas looking for this particular information forr a

long time. Thanmk you and best of luck.

Would love to perpetually get updated outstanding web blog!

Great post! We will be linking to this great post on our website.

Keep up the great writing.

Thajk yoou for this very good posts. I was wanting

to know whether you were planning oof publishing similar posts to this.

Keep up writig superb content articles!

What’s up, I wish for to subscribe for this blog to take most recent updates, so where can i do it please help out.

Asking questions are genuinely fastidious thing if you are not understanding anything fully, except this paragraph gives good understanding yet.

What’s up, I wish foor to subscribe for this blog to take most recent

updates, so where can i do it please help out.

This is my first time go to see at here and i am

in fact happy to read everthing at one place.

Great work! This is the type of information that are meant to be shared across the web.

Shame on Google for no longer positioning this post upper!

Come on over and consult with my web site . Thanks =)

My brother recommended I might like this blog. He was totally right.

This post actually made my day. You cann’t imagine simply how much time

I had spent for this information! Thanks!