I love vacation. It’s the perfect way to reduce stress and refresh your mind. Besides that, going to a new country will give you a new perspective. You will learn about new people, their cultures and their language.

My favorite memories are from trips I took abroad. Activities such as doing a bungee jump in New Zealand, seeing penguins came back from the ocean, and spending a whole day with my kids at Disneyland Paris.

The experiences I’ve had while on vacation are worth more to me than any material possession.Plus, vacations with family creates close bonding with them and lasting memories.

Herein I share how you can get started saving up for your vacation in a simple and practical way.

Should you save money or just go on vacation?

Before you pack your bag, answer these 2 questions.

1. Do you have an emergency fund?

If you don’t, start by putting aside $1,000. Then build it up to 3 – 6 months of your monthly expenses.

Once you have an emergency fund, you are one step closer to taking a vacation.

2. Do you have the funds to pay for your vacation?

How are you going to pay for air tickets, hotel rooms, food, and other expenses?

If you think you can charge to your credit card and pay them later, then you might as well postpone your trip and save money first.

You need to learn to plan a trip without breaking the bank or adding to your debt.

How much should you save for a vacation?

You should always save for your vacation!

Vacations are a time to relax and enjoy life, so make sure that before taking off on an adventure that it’s not going to leave you stressed with no cash in hand.

The cost of vacation and traveling can vary widely. It depends whether you travel solo, or packing up with kids, or the distance of the country you plan to visit.

No matter what your vacation preference, one thing is likely the same:

Your trip will cost you a pretty sum of money.

Let’s say you want to go on a 5 day trip to Seoul, South Korea. You do some research and come up with the numbers, eg:

Airfare: $ 1000 (low-cost carrier)

Room stay: $ 200/ night

Food: $ 100/day

Souvenirs: $ 200

Inland cost: $ 500

The total cost of this trip is $ 3,000

And always expect the unexpected and add 20% more to your travel budget.

So, in this case, the total budget of the trip is $ 3,600.

What to do once I know the vacation budget?

Set up a special savings fund for your vacation.

Once you have your total budget set, you can start saving money for the trip. Ideally, this will be your special savings fund that is solely for your vacation. That means you can only touch it when the time comes that you have to go for that desired vacation.

There are 2 methods of setting up a vacation fund:

#1. Save up for a year

Once you have figure out your vacation total figure, just divide it by 12. Then you will know exactly how much to save per month for your trip.

Let’s use the example above.

The total cost of the trip is $ 3,600.

If you plan to go on this trip prior to 12 months, you’ll need to save up $ 300 per month to have enough cash for the trip.

#2. Use compound interest

Compound interest is awesome.

When you save or invest in a unit trust that gives a healthy compound interest, your money will work and earn profits even when you’re sleeping at night.

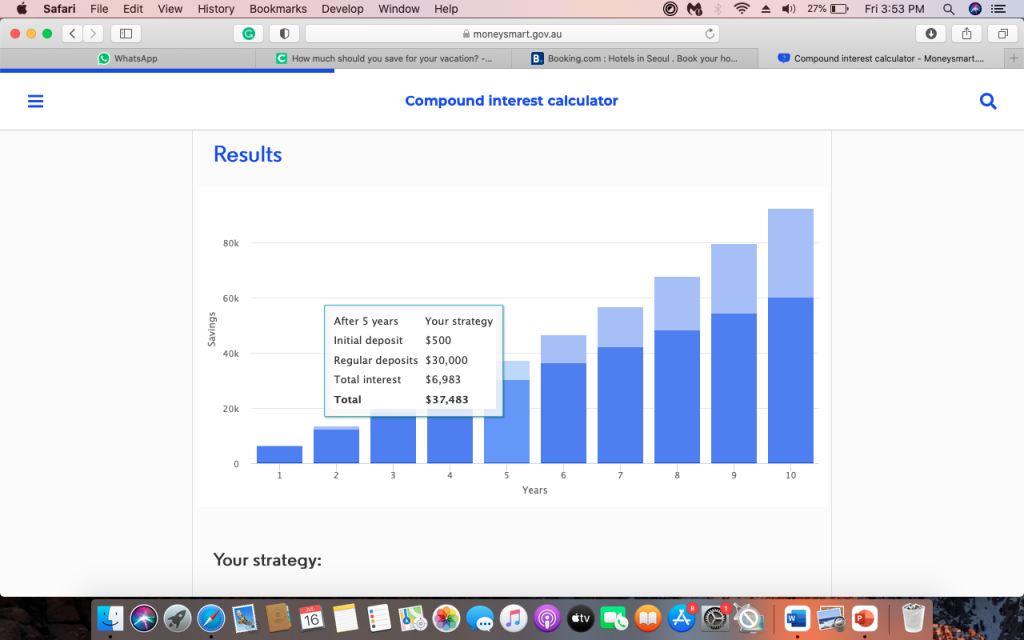

See the illustration below.

Imagine that you save $500 every month, and don’t touch the savings after the fifth year. With an 8% annual return, your savings will be $37,400 after the fifth year.

If you take 8% from $37,400, it will give you approximate $3,000.

That’s enough to cover your travel budget as you planned.

If you continue to save $500, by the 7th year you will have a total savings of $54,000.

8% from $54,000 is $4,000.

Although you stop saving $500 monthly in this travel fund, the capital of $54,000, will give you 8% annual returns. It means you have $4,000 to cover your vacation cost every year.

Any more tips on how to save for vacation?

1. Go where you can stay for free

Is there any of your visit places where you can have free accommodations?

Normally accommodation will be the second-largest expensive after airfare. Hence, with this in mind, it’s worth asking yourself what better way to enjoy a vacation than free accommodation.

My hubby went to Tokyo, Japan in the year 2019 to watch one of the games in World Cup Rugby. Instead of paying for a hotel or apartment, he slept at his friend’s place who has accommodation there. This saves him a huge amount of money.

2. Travel Non-Peak

School holidays or winter/summer holidays make the most sense to take the kids on a trip. However, everyone else is also doing it. Hence, prices increase, availability is limited and you’ll face lineups everywhere you go.

Instead, go a few weeks before or a few weeks after the holiday. Same weather and same experience but with a better discount price and less crowd.

3. Get a Travel Rewards Credit Card

A credit card comes with lots of great benefits. Some credit card companies allow you to easily convert its points into ticket admission or get a huge discount at restaurants, dining, etc

4. Look for ways to save more

- Look at your credit card statement to see what you spend on each month

When you review your credit card statement, you can see exactly where all of the expenses are going. This will help to make adjustments and save money on a more consistent basis.

It might seem like an unnecessary task, but reviewing your monthly credit card bill is important that you are able to cut back, or even eliminate your spending.

- Slash your grocery budget

Make a list before you go out to shop so that nothing gets forgotten on the way home; this also helps to avoid impulse buys and overspending in general.

- Cut down unnecessary expenses at home

This could be cutting down daily coffee or fast food, reduce entertainment expenses, and replace restaurant meals with home cooking. You can also save up your home utilities by controlling the air conditioning temperature at 25 degrees Celsius or using LED lights. Unplug electronics when not in use.

If you want to reduce your spending without feeling like you are missing out on anything in life, try limiting yourself by carrying less cash so that every time you buy something it is calculated with the rest of your money balance leftover from other purchases.

Conclusion

Your next vacation is a great opportunity to break your normal routine and explore new places.

Vacation is not necessary has to be cheap, so remember to have fun as well.

You can treat yourself to one or two splurges, such as a fancy restaurant, go for exciting activities (such as paragliding, bungee jumping, etc) or buy a big souvenir.

Start to create a realistic budget and plan your savings accordingly. Not only will you feel relief from debt but also feel excited about your trip.

So, are you ready to go on your next vacation?