When I was working in corporate, I never thought of retirement. I was so busy with routines; office works and things I need to do when back home.

However, I witnessed one of my relative’s struggles.

Before he worked in a giant oil & gas company. He earned a good income. He and his family lived a good lifestyle.

Upon retirement, he had only EPF savings. Sadly, it didn’t last long. He exhausted EPF money within a few years. Then at age 62, he had to do odd jobs. Sometimes as a cook, a security guard, or a cab driver.

It was so heartbreaking to see him struggled to support his family at that age.

Hence, I decided to share how important is retirement savings ;

Why do you need to save for retirement?

You might think you are fit to work, perhaps you never want to retire. But the reality, as you age, you’re going to slow down, and certain tasks will become more difficult.

No matter how much you want to keep working, it’s no excuse to not save for retirement.

In Malaysia, most people retire at the age of 55 or 60. It means, people have up to 30 years to retire till the age of 85 (not to forget that Tun Mahathir became Prime Minister for the second time at the age of 93)

A study showed that 85% of retirees in Malaysia feel a sense of regret at not having prepared adequately for retirement. So please, don’t let yourself be part of statistics!

How much is minimum monthly household expenditure?

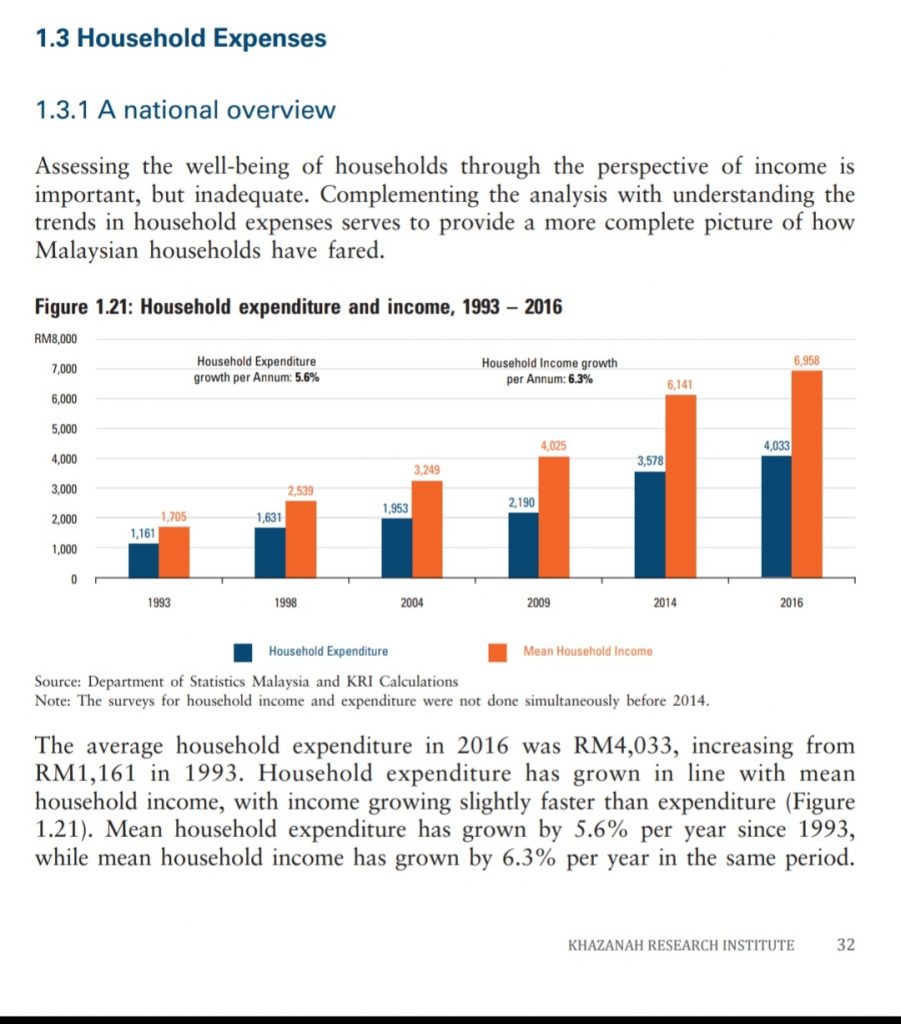

A study was conducted by Khazanah Research Institute. Just take a look at below report from Khazanah on “The State of Household 2018”.

The report showed that;

- the average household expenditure in 2016 was RM 4033 and

- the mean household expenditure has grown at the rate of 5.6% per year

Household expenditure means the amount of monthly consumption or expense made by resident households to meet their everyday needs, such as food, clothing, housing utilities, energy, transport, durable goods (eg. car maintenance), health costs, leisure, and miscellaneous services.

Thanks to the Khazanah report, now we can predict or plan how much that we need at least to cover for necessity requirement (take note that this doesn’t cover lifestyle such as traveling, new car, etc).

Is EPF savings alone enough for retirement?

A study showed that 70% of ex-EPF members ‘habis’ their EPF savings within 10 years.

Why?

Look at this logic.

On average, a person contributes 11% to EPF, and an employer’s contribution is about 12%. So the total monthly contribution for a person is about 23%.

If the person withdraws money from EPF account 2 for house or education needs, then the percentage of total contribution reduced to 17%.

After retirement, should he do not downgrade the lifestyle to 15 – 20% of his usual monthly expenses, then EPF savings would be exhausted really fast.

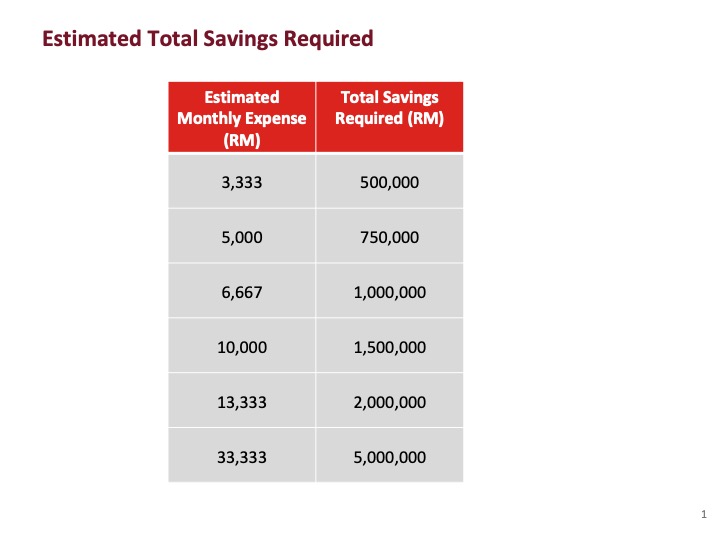

How much do you need to have to retire comfortably?

One common rule of thumb is that you will need to have at least 70% from the last withdrawn of your monthly income.

For example;

Your salary during the last working year is RM 10,000.

Then you may need RM 7,000 monthly income (from your savings) during retirement.

For a quick calculation, the below table is the total amount you need based on the monthly income that you may require during retirement.

How to build a good retirement savings?

1. Save or invest 10% – 15% of your income for retirement savings.

Why 15% ? Because it’s an amount that not too big and still allows you to spend on what you want.

2. Use a tax-advantage retirement plan.

PRS is a voluntary scheme for retirement. Depositor to PRS may enjoy a personal tax relief up to RM 3000.

3. Diversify your retirement fund.

It’s a big risk when you put your retirement money all in one place. My recommendation is to diversify your financial portfolio as below;

60% – Conventional fund eg. EPF, ASB, ASW, Tabung Haji.

30% – Unit Trust with diversified portfolio eg. equity, balance, sukuk funds

10% – Alternative or high-risk investment (if brave enough!)

4. Don’t be too conservative.

At age of 45 -50, you have about 10 years and more for your retirement savings to grow. So, invest a certain portion in a proven and good performance unit trust.

5. Be discipline.

To build wealth successfully, you need patience and discipline. There is no shortcut to success. It just hard works and a lot of patience.

6. Work with professional.

You need someone who can help create investing plan that fits with your life and your financial goals – it means working with a financial consultant that you can trust.

Retirement planning is too important to figure out on your own.

Where should I keep my retirement savings?

I recommend you diversify your retirement savings. Don’t put all eggs in one basket. Please ensure the institutions you choose are legit and give decent annual returns.

Don’t put your retirement savings in place with;

1. High volatility eg. Stock market, Forex trading, Bitcoin

2. Zero interest return eg. Savings or Current account

3. Low-interest return eg. Fixed Deposit (FD), Money Market

4. Unknown or unproven investment eg. Skim Cepat Kaya (Rich quick scheme)

The best account for your retirement savings;

1. EPF (Employee Provident Fund)

A compulsory savings plan and retirement planning for private-sector workers in Malaysia. So far, EPF has given a healthy dividend, an average of 5 – 6% per annum.

2. ASB

ASB is a unit trust fund with a fixed RM 1 per unit. The investment is mostly for Bumiputera citizens in Malaysia. Each eligible investor is limited to a maximum investment of RM 200,000.

The investment in ASB is low risk, with consistent and competitive dividends of 5 – 7% per annum.

3. PRS

PRS is a voluntary scheme for retirement plans. You are allowed to claim tax relief on the amount of PRS savings that you make, up to a maximum of RM 3000 per year.

4. Principal Unit Trust

Principal Asset Management Berhad is an asset manager, headquartered in Malaysia.

You have 2 options to save in Principal;

1. Lump sum savings

Principal has many good funds which could give an average of 8-10% returns yearly. However, note that the investment in Principal should be mid to long-term basis.

2. Monthly savings

Save money every month is a simple and yet effective strategy that will help you grow your wealth. As the market is always up and down, monthly savings helps to take the fear out of investing and you do not need to time the market.

When market up, you will benefit from the capital gain of the fund’s price. If the market down, you will benefit from a lower price and get more units of that fund.

How much you can spend from your retirement savings?

Ideally, a yearly withdrawal should be about 8% of your total savings. If you put your savings at an institution that generates 6 -7% annual returns, then your money is enough to sustain throughout your retirement (perhaps may last more than 20 years though).

Based on the Khazanah Research Institute report above, I did a quick calculation of the MINIMUM money that you need if you plan to retire as of that particular year.

But, Please take note that this doesn’t cover lifestyle such as travelling, new car etc. It also does not cover other expenditure like kid’s college fees, kenduri kahwin anak (kid’s wedding cost).

So take a look at your total savings (including EPF, FD, ASB, Tabung Haji, and Unit trust) and see if your retirement savings are on a right track.

What to do after you start saving for retirement?

Conclusion

Everyone’s retirement income needs will be different. You have to carefully think through your anticipated expenses and your future potential income.

The earlier you plan for your retirement, the better your life after work.

About the Author

Khairul, is a Certified Consultant registered with Principal, founder of Khairul Abu Bakar blogsite and the LinkedIn Spotlight 2019.

I抦 impressed, I have to say. Really not often do I encounter a weblog that抯 each educative and entertaining, and let me let you know, you may have hit the nail on the head. Your idea is excellent; the issue is something that not enough persons are talking intelligently about. I’m very glad that I stumbled across this in my search for one thing regarding this.

Thanks so much Braid Hairstyles for reading my blogs. I truly appreciate your supportive and kind comments. It means a lot to me.

I do hope this weblog will provide you and other readers good insights 🙂

Thanks again Braid Hairstyles.

I抎 have to verify with you here. Which isn’t something I usually do! I get pleasure from studying a post that can make individuals think. Also, thanks for allowing me to remark!

The pleasure is mine Easy Hairstyles. I’m glad that you like my writings.

And for you to put comments here is valuable. At least I know that someone’s reading the post and appreciate the content.

Thanks so much ya 🙂

Thanks for the concepts you reveal through this site. In addition, many young women that become pregnant usually do not even aim to get health insurance coverage because they have anxiety they probably would not qualify. Although a lot of states now require that insurers provide coverage irrespective of the pre-existing conditions. Costs on these types of guaranteed programs are usually greater, but when taking into consideration the high cost of health care bills it may be the safer route to take to protect a person’s financial future.

Thanks for the input Bob Hairstyles. You’re absolutely right that taking a healthcare insurance coverage is essential irrespective of your conditions. The premium cost might be slightly higher, but it gives you a peace of mind.

OH come on!