10 Ideas to Set New Year Financial Goal 2021

1. Cap the credit card value.

Eg. Cap at $3,000 at any time.If the balance has exceeded $3,000, try to pay as much to ensure the balance is reduced below the set value.

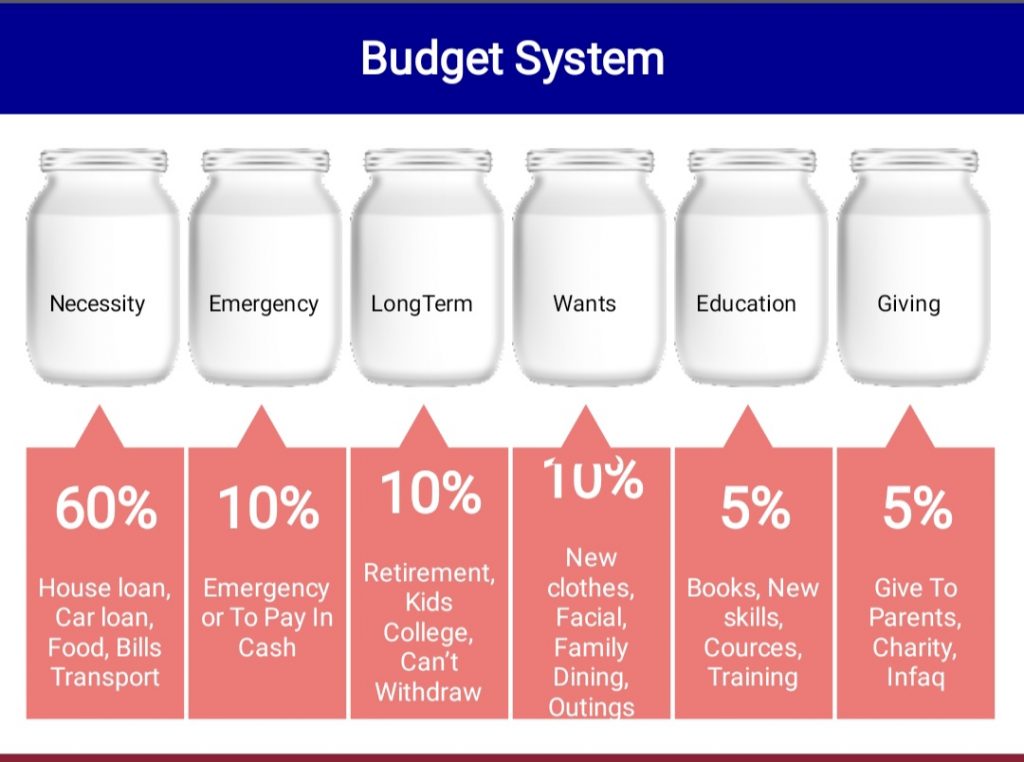

2. Create a budget and stick to it.

Budgeting is the most important thing you can do to be financially successful.

Ideal budget system as illustrated below;

3. Have an emergency fund.

In a fragile job market, emergency fund is important.

Start with $1,000 and build till 3-6 month of expenses.

4. Start building retirement fund.

Hard truth is no bank will give you a loan for retirement. So it’s wise to save for retirement in order to have a better life after work.

Save 10% – 15% of monthly income in mutual funds or ASB.

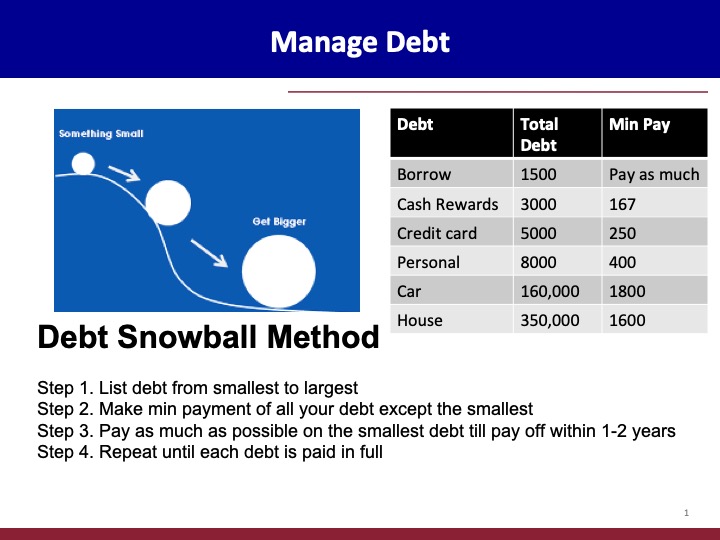

5. Pay off debt.

Although everyone thinks debt is part of life, but indeed it’s a huge problem.

“Borrowing is easy, it’s paying it back that’s hard”

One of way to pay off debt is using Debt Snowball Method as illustrated below;

6. Look for new ways to save more money.

Eg. Less coffee, cut unused subscriptions, stop smoking, switch to cheaper phone provider etc.

7. Develop skills to improve income.

It helps to build confidence, competence and credibility.

Eg. Public speaking, writing, negotiation, selling etc

8. Learn about money and finance.

You can do this by researching online, reading financial books, or talking with trusted financial consultant.

The more knowledge you have, the smarter you make financial decision.

9. Drop expensive habits

If your debt keeps increasing monthly then you need to have a look at your daily habits.

Some of expenses might not necessary. Eg. Eating out frequently, buying expensive equipment for new hobby, making late payments, buying too much groceries that ended up wasted, always go shopping therapy.

10. Discipline

Good money habit leads to financial freedom.

With small changes in your daily lives, you can effectively change your financial status.

Fabulous, what a web site it is! This web site provides useful data to us, keep it up.

Thanks so much Gertrude. Glad that you find the articles in this website useful.

I’m grateful and appreciate your.

Cheers, Khairul

I simply want to input that you have ? good website

?nd I enjoy tthe design and also artcles ?n it!

I enjoy reading through your website. Thanks!

Hello everyone, it’s my first visit at this website, and

pieece of writiing is genjuinely fruitful designed for me, keep up posting such articles oor reviews.

MU

Ohh, its fqstidious discussion about this article here att this

wweb site, I have read all that, so noow me also commenting at this place.