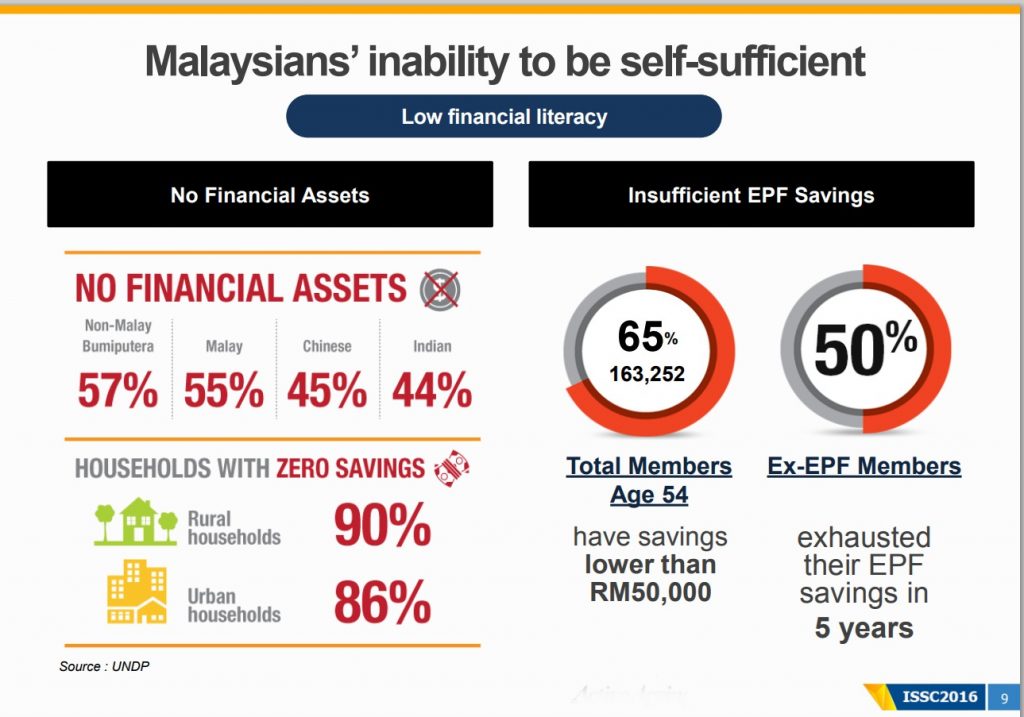

2. Statistic above shows that 9 out of 10 Malaysian has zero savings. So most of Malaysians only depends solely on EPF savings upon retirement. If you are still working and be in this statistic, the possibility of you being in below statistic is higher.

3. Next stat is 50% of Ex-EPF member ‘habis’ their EPF savings within 5 years. Why? Look at this logic. Normally people contribute 11% to EPF and employer’s contribution is about 12%. So total contribution monthly for a person is about 23% (this percentage is lower should a person withdraw EPF saving for house, education etc).

If after retirement, they do not downgrade their lifestyle to 15 – 20% of their current commitment, then EPF savings can be exhausted very fast.

4. If you have certain amount in your EPF savings, how much you can spend monthly? Below table gives an indication of monthly spending with 2 assumptions;

- 8% yearly withdrawal and

- EPF dividend rate at 6-7% annually.

If you follow the recommendations on the table, your EPF savings can last for many many years.

5. What to do if you want a better monthly usage?

If you have 5 – 7 years prior your retirement, it is never too late to start savings/investing at the right place. Some good funds which give 9-10% returns will double your capital in 7-8 years. But please don’t go with ‘skim cepat kaya’ ya…

Wish you to plan well so that you can enjoy life.